Hi everyone, I'm David Waltrip, a certified financial planner with Bridgeview Capital Advisors and the astute advisor personal finance site. Today, we're going to discuss how SIMPLE IRA matching works. This is a topic that often confuses employers and employees participating in SIMPLE IRA plans. There are two methods of matching for a SIMPLE IRA plan: 2% non-elective and 3% elective. These terms might be unfamiliar, but it's essential to understand how they work. First, let's talk about the 2% non-elective matching component. The key thing to remember is that this method requires no contribution from the employee to receive a match from the employer. Whether the employee contributes or not, they will get a contribution from the employer. For example, let's say an employee has a $100,000 salary and contributes $5,000 to their SIMPLE IRA. The company is only obligated to contribute $2,000, which is 2% of the employee's salary. The employee's contribution amount doesn't affect the employer's contribution. In another scenario, an employee earning $100,000 a year contributes $2,000. In this case, the company must match the employee's contribution, meaning they will contribute $2,000. The 2% non-elective contribution is always based on the employee's salary, not the employee's contribution amount. Now, let's consider a situation where an employee with a $100,000 salary contributes zero dollars to the plan. Even in this case, the employee will still receive a $2,000 contribution from the employer. The 2% non-elective component allows employees to receive money from the employer, even if they don't contribute themselves. Moving on to the 3% elective matching component, it means that the business must match employee contributions dollar for dollar, but only up to 3% of the employee's compensation. In other words, the employee won't receive any dollars from the employer unless they contribute their own money. However, the employer is only...

Award-winning PDF software

Simple ira rules 2025 Form: What You Should Know

The Simplified Employee Pension (SEP) IRA. The Simplified Employee Pension (SEP) IRA The tax advantages of using this simplified IRA plan are limited to those participants whose modified adjusted gross income is less than 185,000. The Simplified Employee Pension (SEP) IRA is the easiest way for small businesses to set up an account that is tax-free but still has access to the full amount of their employee's contributions. For companies that already have SEP accounts, the Simplified SEP IRA would provide a safe place for employees' 401(k) contributions by letting them contribute as they do without taxes and penalties. SEP IRAs, which are managed by John Hancock Investment Management, may provide some tax benefits (including the ability to defer taxes until distributions are made) while increasing the total amount of money that can be contributed to their own retirement plans by employees and their employers. John Hancock also serves as custodian for this type of account. The Simplified Employee Pension (SEP) IRA is one of two types of tax-deferred retirement accounts (the other type of plan is the Simple IRA). SEP IRAs provide benefits to those who are able to contribute at least 10% of their compensation and those who plan to contribute at least 10% of their compensation as well as the employer match. SEP IRAs are a tax-deferred account designed to meet needs of those who have a high tax rate or with high investment accounts. Participants can make SEP contributions or roll those contributions into their personal IRA when their income exceeds a certain level while still enjoying significant benefits— including no penalties. SIMPLE Plan — 401(k) IRA The purpose of the SIMPLE Plan is to facilitate the creation of SIMPLE IRAs at your organization. SIMPLE IRAs, if established, will be tax-free for employees without penalty. It is a simple way to create tax-free, tax-advantaged savings for your employees, while still providing for a simple way to manage that money. For more information on SIMPLE Plans and the SIMPLE IRA, see ... Simplified IRA — John Hancock Investment Management The Simple IRA provides the benefits of an IRA, with the convenience of a 401(k) plan. SIMPLE IRAs provide tax-free growth for an employee without the added expense of an account balance.

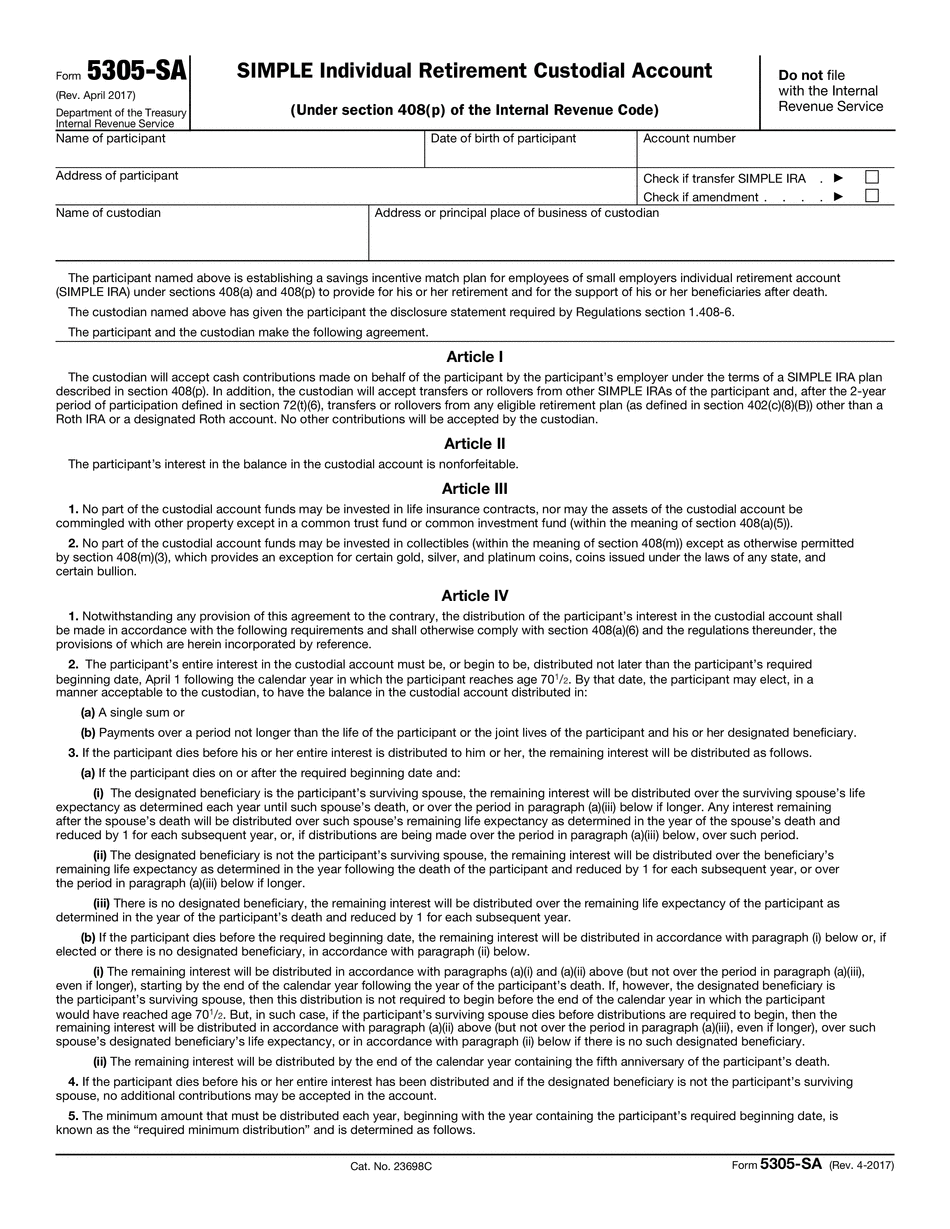

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 5305-Sa, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 5305-Sa online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 5305-Sa by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 5305-Sa from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Simple ira rules 2025