Hi there, Jon Bowens with Equity Trust Company. In this segment, we're going to be talking about the 2019 contribution limits for the seven tax-exempt or tax-advantaged investment accounts. And all of these accounts are self-directed, meaning that in addition to traditional stocks, bonds, and mutual funds, you can also invest in real estate, private lending, real estate private equity, precious metals, and a wide array of other alternative investments. Let's get to the whiteboard. So here are the seven tax-advantaged investment accounts that we're going to be talking about: the traditional IRA, Roth IRA, and then there are three business plans: SEP IRA, SIMPLE IRA, solo 401k. And lastly, we'll talk about the Coverdell education savings account as well as the health savings account. Yes, that's right, you can actually self-direct a Coverdell education savings account and health savings account, and potentially buy real estate, do private lending, and invest in other alternative assets. Now, let's first talk about the traditional and Roth IRA. It's important to understand the tax nature of these two accounts. A traditional IRA is a tax-deferred account, meaning that when you put money into the account, you get a tax deduction for it. It grows tax-deferred, and then when you take the money out after the qualified retirement age of 59 and a half, you have to pay taxes. In contrast, the Roth IRA is funded with after-tax money, so you don't get a tax deduction. It grows tax-free, and when you take the money out after 59 and a half, you don't have to pay taxes. So as you can see, there are advantages to both the traditional and Roth IRA from a tax mitigation perspective. Now let's talk about the contribution limits. When under the age of 50, if eligible, you can contribute up to...

Award-winning PDF software

Simple ira contribution deadline Form: What You Should Know

SEP-IRA IRA Contribution Withdrawal Reporting SIMPLE IRA Contribution Withdrawal Limits The minimum monthly contributions to any SIMPLE IRA Plan The minimum weekly contributions to any SIMPLE IRA Plan The IRA Contribution Limit for 2025 for most SIMPLE IRA Plans and for SEP and SIMPLE IRA Plan members The IRA Contribution Limit for 2025 for most SIMPLE IRA Plans and for SEP and SIMPLE IRA Plan members In accordance with IRC Section 408(n), IRA Distributions cannot exceed the excess contributions over the salary reduction contribution limits listed in Schedule B-4, Section 6056(a). IRC Section 408(n), IRC Section 6115(o)(3)(A) or IRC Section 6113(b)(1)(A) SIMPLE IRA Contribution Withdrawal Reporting Period: Generally, a contribution to an SEP IRA or a SIMPLE IRA is not subject to the SIMPLE IRA Contribution Withdrawal Reporting Period. However, a contribution made to an IRA can be reported with the IRA Contribution Withdrawal Periods. IRS Form 5402-SIMPLE (Rev. March 2012) Form 5604 (Form 5304-SIMPLE) — The IRA Annual Distribution Reporting Process, Fidelity Investments For IRA members who contributed amounts in excess of the amount of deduction, up to the combined contributions allowed for both SEP and SIMPLE IRA plans, the IRS requires that the IRA account be transferred to Fidelity Investments before the IRA member's tax return is due. IRS Form 1099-R/ Form 5452-SIMPLE/Form 5452/ Form 5452-SEP (Rev. April 2018) 2 SIMPLE IRA Excess Contributions. Taxpayers may exclude 50% of any excess contributions up to 3,000 (5,000 in 2017), in the form of a nonqualified distribution from their SIMPLE IRA. The contribution or withdrawal will count as a disqualifying IRA contribution for the year of the distribution. The following types of distributions are not eligible for exclusion: Any distribution from an IRA, including an IRA that is excluded from includible earnings under IRC Section 408(n) or a distribution of money, other than a distribution of money from a Roth IRA, made in accordance with Form 5500.

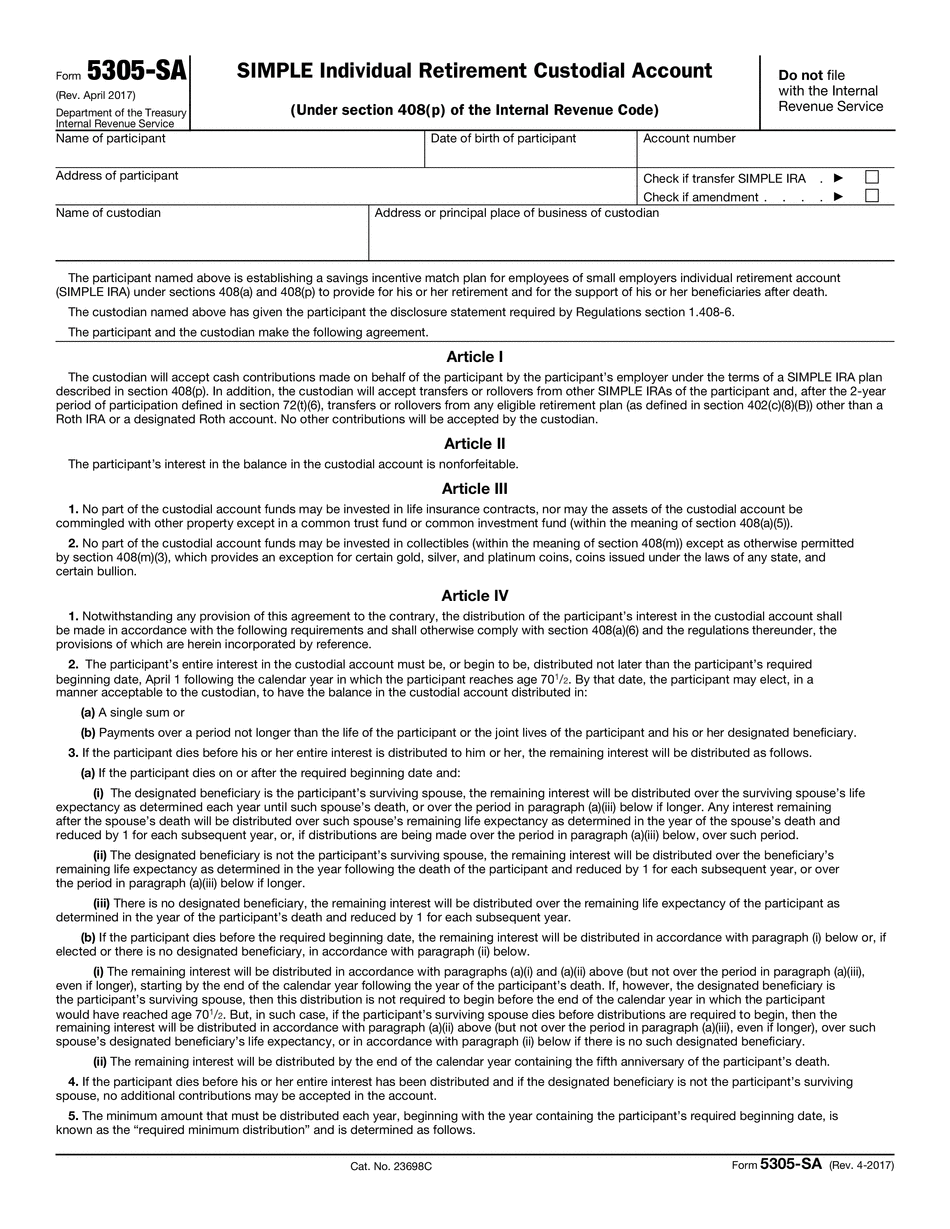

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 5305-Sa, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 5305-Sa online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 5305-Sa by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 5305-Sa from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Simple ira contribution deadline