Hey guys, it's a mom and Christina from Aris Journey. Today, we are going back into our Vanguard portfolio to share with you some more of our holdings. However, this time we are going to focus on the ETFs that we own. If you've been watching our channel, you know that about three months ago we went over everything that we owned, but we really skimmed over the ETFs. Since then, we've received over 400 comments and 75,000 views on that video, so we want to go back and delve deeper into this topic. In today's video, we'll be focusing on the ETFs that we are investing in for financial independence. If you've been following our previous videos, you know that we also invest in index funds. Our favorite index fund of all time is VTSAX, and we've already made a video on that. However, in this video, we really want to talk about ETFs because our ETFs have been ing exceptionally well. Some of our ETFs have seen gains as high as 28% at the moment. Before we jump into discussing the ETFs we invest in, let's cover two things first. We want to define what an ETF actually is and then talk about why you should consider investing in one. An ETF, also known as an exchange-traded fund, trades on various stock exchanges such as the New York Stock Exchange and Nasdaq. Essentially, ETFs function just like stocks, allowing you to buy and sell them in the same way. However, the key difference is that ETFs hold a diversified portfolio of stocks or bonds within a single fund, often consisting of tens, hundreds, or even thousands of individual holdings. If you've owned a mutual fund, particularly an index fund, you'll find ETFs similar in terms of structure. One major advantage of...

Award-winning PDF software

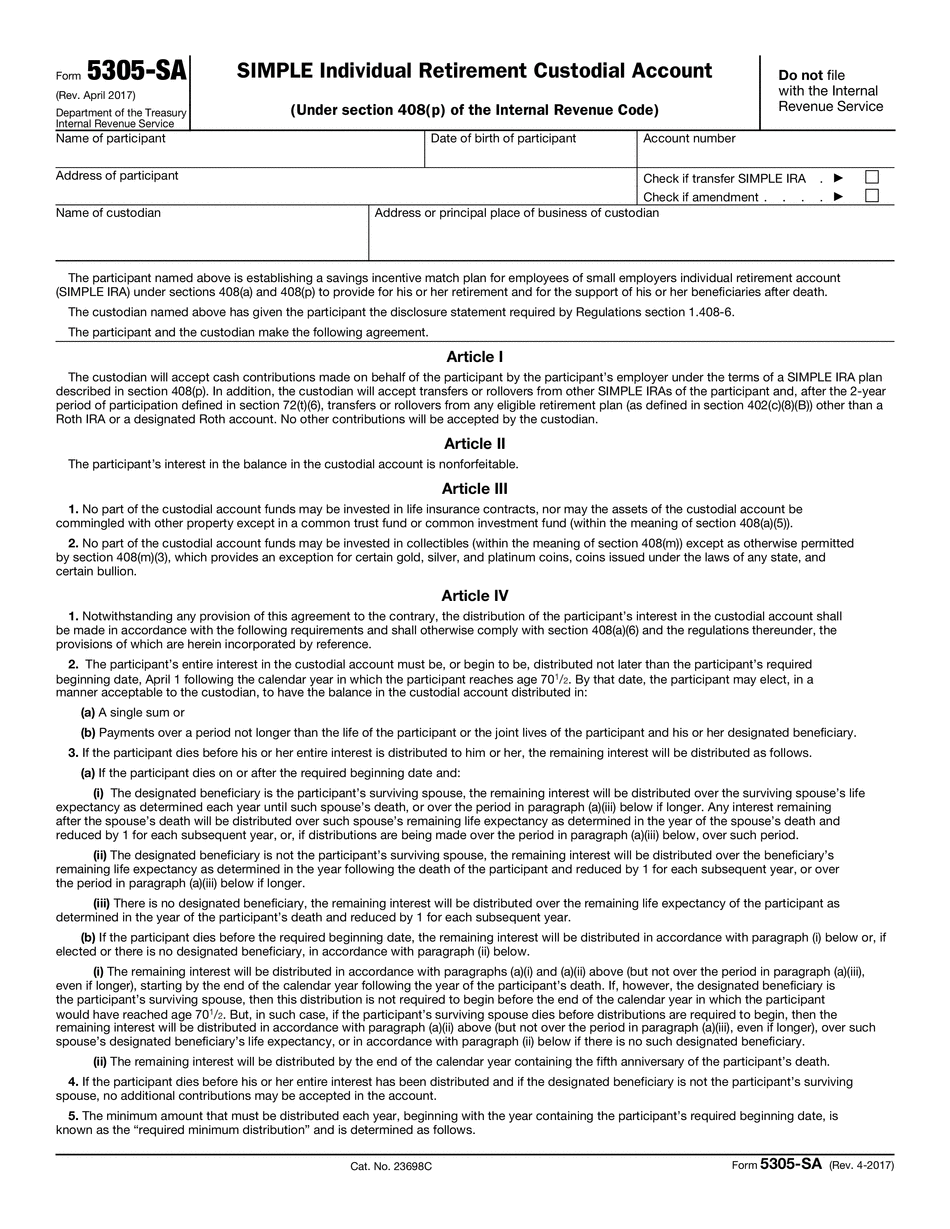

Vanguard 5305-simple Form: What You Should Know

Your plan includes a “SIMPLE” IRA under § 408 of the Internal Revenue Code (IRS), with or without an educational trust. If you have a SIMPLE plan, a SIMPLE IRA fund must be at least a 5% portion of any contribution. You cannot use this form to change your name to include a middle initial. This form is used for the SIMPLE IRA purposes. Vanguard Form 5309/RFI/RFI — Vanguard — Form 706 If your plan uses a SIMPLE IRA, you may want to make certain that we know where to send Form 5309/RFI/RFI. Form 706 contains information to help us send your tax-exempt, pre-tax IRA contributions to your plan.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 5305-Sa, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 5305-Sa online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 5305-Sa by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 5305-Sa from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Vanguard 5305-simple