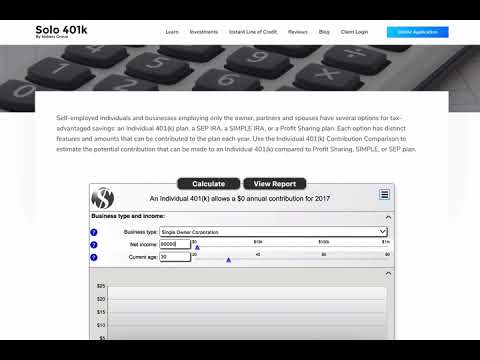

The solo 401k is the most powerful retirement account on the planet when it comes to contributions. This can add up to huge tax savings for you if you own your own business. With a traditional IRA, you can contribute up to five thousand five hundred dollars per year. However, with a solo 401k, you can contribute up to fifty five thousand dollars per year, double that if you're married. The reason you can contribute and deduct so much money with the solo 401k is because you are both the employer and the employee in your business. Essentially, this allows you to make two types of contributions, maxing out more than any other retirement plan. Let me show you how to calculate your contributions with the solo 401k contribution calculator. First, input your business entity type as the contribution limits vary slightly based on your business structure. Select unincorporated sole proprietorship if your business is just you or a single-member LLC. Select single owner corporation if your business is an LLC taxed as an S corp, a multi-member LLC, an S corp, or a C Corp. Next, you'll input your net income. If you were a sole proprietor, this is the net compensation you were paid from your business. Generally, this will show up on line 31 in Schedule C of your income tax return. Let's say your business has a gross annual revenue of two hundred and fifty thousand dollars. You typically have about ninety five thousand dollars in expenses, which leaves a hundred and fifty five thousand as your net income as shown on Schedule C of your tax return. Input a hundred and fifty five thousand into the calculator under net income. Finally, input your age. If you are age 50 or older, you get an extra six thousand dollars...

Award-winning PDF software

Simple ira employer match calculation Form: What You Should Know

The contribution is calculated for each month using the following formula, where the first two digits are that month's compensation figure [Employer's full name] 2% of base compensation. Enter your SIMPLE Plan employer contribution using this table. Annual contribution limit is 3,000. To calculate each month's contribution simply divide the employee's compensation by 52 months. For example: To determine the number of months each contribution will be paid out and the amount, enter the answer on your tax return and complete IRS Form 1099-R, SIMPLE IRA Contributions. To determine the amount due each month, divide the year-end amount paid by the calendar year. For example: The contribution is based on each SIMPLE plan participant's compensation for a calendar year. For employee's contributions to be made, the IRS requires that the SIMPLE Plan participant's employer (for the SIMPLE Plan) be a plan participant or participant in a plan with a SIMPLE Plan. For a summary of the IRS rule, see IRS Publication 970, SIMPLE Plans, which can also be found by clicking here. For further questions, email. The employer must enroll the SIMPLE Plan participant. The employer must offer the SIMPLE Plan participant a choice of participating SIMPLE Plan plans. For employees to participate in a SIMPLE Plan that offers employer matching contributions (including the employer's own contributions), the employee must be employed full-time or on a part-time basis for a period of more than 30 days during the plan year or during the immediately preceding calendar month. For employees who can make contribution options, it's important for the employee to understand what he has in front of him. A SIMPLE Plan, if adopted, may contain terms or requirements that would impose upon the eligible SIMPLE Plan employee certain obligations and impose a tax on or impose a penalty on the eligible employee for the plan year. SIMPLE Plan FAQs No. A SIMPLE Plan cannot be made effective prior to October 1, 2017.

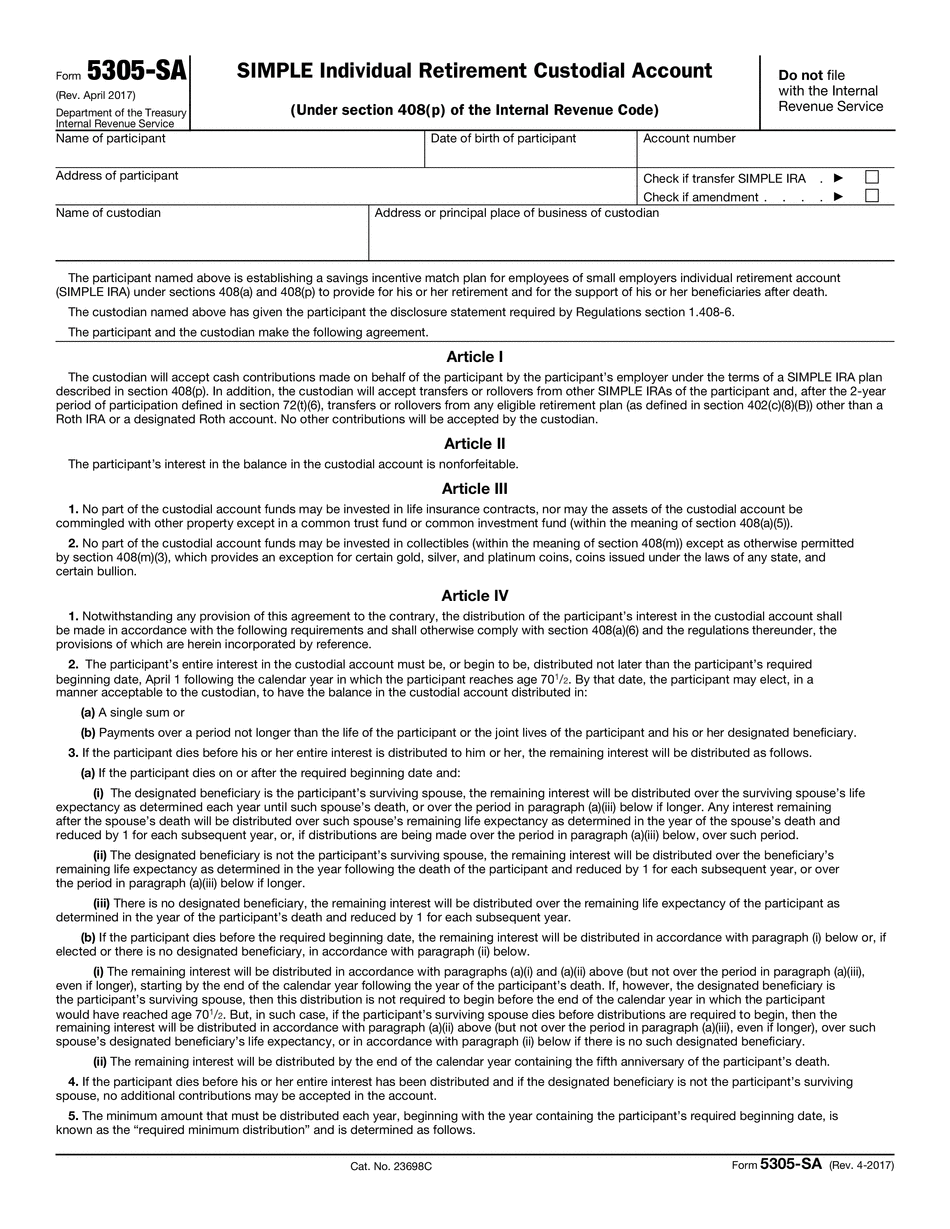

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 5305-Sa, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 5305-Sa online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 5305-Sa by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 5305-Sa from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Simple ira employer match calculation