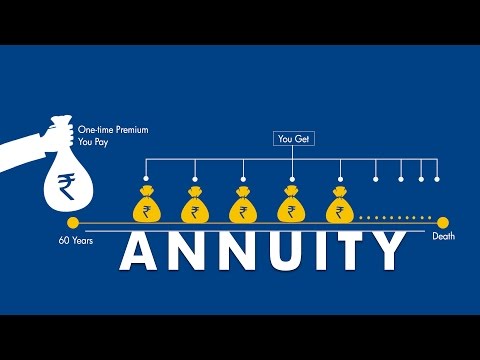

You an annuity is a financial product that is sold by life insurance companies. - It helps you generate a fixed regular income for the rest of your life. - Let me explain how this works: you pay a lump sum amount to the insurance company, let's say 10 lakh rupees. - In return, the insurance company will pay you around 70 thousand rupees every year for the rest of your life. - You can choose to receive the 70 thousand on a monthly, quarterly, half-yearly, or annual basis. - Now, let me explain with the help of a pension plan how it works in India. - Let's say at the age of 35, you buy a pension plan and invest regularly for the next 25 years. - At the age of 60, you have accumulated an amount of 24 lakhs. - According to the current rules of the insurance regulator, you can only withdraw one-third of this amount for urgent personal requirements. - So, out of this 24 lakhs, 8 lakhs can be withdrawn for personal requirements, and the rest of the 16 lakhs have to be invested in purchasing an annuity from the same insurance company. - Of course, you can choose to use the entire 24 lakhs to purchase an annuity from the insurance company. - When you make this lump sum payment to the insurance company, they will fix an interest rate at which they will pay you regularly. - Let's assume the interest rate is 7% on 24 lakhs. - At this interest rate, they will make a payment of one lakh sixty-eight thousand rupees to you every year. - This interest rate does not change, which is the advantage of purchasing an annuity. - The insurance company makes money if they can use the capital you have invested to generate income greater than 7%. - However, they stand to lose...

Award-winning PDF software

Simple ira compensation definition Form: What You Should Know

SIMPLE IRA Plans for Small Businesses. The compensation does not include commissions, bonuses, payments for the sale of equipment, etc. FAQs: Plan Sponsor | Fidelity Institutional An employee's compensation for this purpose is his or her wages as reported by the employer as of April 18th of the year. The SIMPLE IRA Plan and SIMPLE IRA Contribution Limits The maximum amount an employee may contribute each taxable year for a SIMPLE IRA is 5,500 (6,500, underage 59½), unless: (1) Employee is a covered employee who meets certain qualification requirements. (2) Employee is an eligible employee (as defined in IRC §500A) who meets certain qualification requirements. (3) Employee is not a member of a partnership. The SIMPLE IRA Plan — Contribution Limits for Employer Sponsored Plans A joint venture, limited liability company, or partnership with 25 or fewer shareholders may contribute the following amounts per year for a SIMPLE IRA for the plan year: 5,500 (6,500, underage 59½), unless: (1) Employee is a covered employee who meets certain qualification requirements. (2) Employee is an eligible employee (as defined in IRC §500A) who meets certain qualification requirements. (3) Employee is not a member of a partnership. The SIMPLE IRA Plan and the Deductions for SIMPLE IRAs The following are limitations to the deductions that may be claimed on the basis that an individual is an employee under the Internal Revenue Code with respect to the contributions made. These are applicable whether any SIMPLE IRA contributions are made to an individual or to a plan that has a qualifying participant or beneficiary. (a) Deduction on Form 1099-MISC Made Before September 11, 2001. Contributions made on or after September 11, 2001, may be claimed as an excise tax on Form 1099-MISC. You are presumed to make these contributions if the covered employee (C) is a member of a SIMPLE IRA plan, (b) Deduction on Form 1099-MISC Made on or After September 11, 2001. Contributions made between September 11, 2001, and September 14, 2004, may be claimed on Schedule A for the year.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 5305-Sa, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 5305-Sa online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 5305-Sa by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 5305-Sa from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Simple ira compensation definition