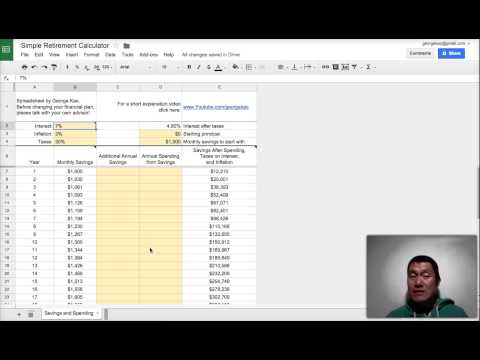

Hi, this is George Cal. This is a bit of a different kind of short video. It's about finances. I've been going through the five essential habits for authentic business success, and good financial skills is one of those five essential habits. It is really, really important for you to be saving for those years at the end of your life where you cannot work anymore physically or mentally. So, I recommend that you aim to save for at least 10 years of living expenses. This way, when you can no longer bring income in for yourself, you have those savings that will support you. I've created a tool here for you to use, which I'm also using for myself. You may find it helpful as well. Please note that I am not your financial advisor, so please check with your own advisor or do your own double-check the math. Don't make any financial decisions just based on my plan. Do your own due diligence. But this plan will hopefully motivate and inspire you, giving you some direction and ideas for your own savings. The yellow cells in the document can be changed, and I'm going to link to this document so you can copy it and have all the formulas yourself. The white cells should stay the same, but just the yellow cells can be changed. For interest rate, I'm assuming 7 percent, which at this time in 2015 is not difficult to get stable and reliable returns. I recommend LendingClub.com. In my opinion, it's more socially responsible than investing in the stock market and it's also more reliable and less volatile. Prosper.com is a competitor to LendingClub, so you should check them out. I personally prefer LendingClub. For inflation, I'm assuming 3 percent, which is the US historical average and is...

Award-winning PDF software

Simple ira age 21 Form: What You Should Know

SIMPLE IRA contribution — Employer guide and adoption agreement The purpose of this form is to provide you with information about the IRA Savings Incentive Matching Plan, to provide your employer with information relating to this plan, and to provide you with notice of your right to choose, through your election, to contribute to the IRA via a SIMPLE IRA. SIMPLE IRA (SEP) — State of Michigan The purpose of this form is to provide the Secretary of State of Michigan (Secretary) with all necessary information and supporting documentation in order to determine your status under the state's SEP. SIMPLE (SEP) — IRS The purpose of this form is to provide the IRS with all necessary information and supporting documentation to determine your status as a SEP participant, prior to the annual enrollment period for the purpose of determining eligibility for the IRA SEP Program SIMPLE/SEP: The Benefits of SIMPLE/SEP Contributions — Eileen G. In a typical, self-directed SEP, you will pay income tax on your contributions that are not used for qualified retirement plans. SIMPLE/Vanguard Simplified Employee Pension (SEP) — IRS Form 4562 must be filed with the IRS prior to contributions to a SIMPLE/Vanguard SEP. SAE-SIMPLE: Savings Incentive Matching Plan — Schwab You are eligible for this matching employee program when you meet all the eligibility criteria. You may pay a contribution of up to 1% of eligible compensation each year for a total of 5,200. To be in the program, you must be at least age 50, and you must have worked for the employer for at least 5 years before participating. (You must make an election with your plan. Eligible compensation means compensation for which you receive at least 10% of your compensation as salary or wages.) SAE-SIMPLE: Retirement Plan Disclosure Statement — Schwab This disclosure statement provides the benefits and risks of Schwab's retirement plan. The statement includes: a description of each defined contribution component of your plan, including contributions and earnings based on age; how these components will be impacted by employer or employee contributions, tax benefits, investment choices and investment allocations. SAE-SIMPLE: Retirement Plan Disclosure Statement— Schwab This disclosure statement provides the benefits and risks of Schwab's retirement plan.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 5305-Sa, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 5305-Sa online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 5305-Sa by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 5305-Sa from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Simple ira age 21