Award-winning PDF software

Form 5305-SA Dayton Ohio: What You Should Know

Unclaimed Funds Accounts, which are managed by the State of Ohio, State of Ohio's Unclaimed Funds Account (SEA) Program Division, in accordance with the United States and State Unclaimed Fund Laws. We'll explain about Ohio's new, streamlined Unclaimed Funds Account and how to claim your funds! - - - - - - - - - Unclaimed Money Laws & Rules You Should Know Unclaimed Money Laws & Rules You Should Know - - - - - - - - - Ohio Unclaimed Fund Program Unclaimed Program Overview - - - - - - - - - Overview Ohio is one of thirteen (13) States that operate an Unclaimed Program to collect, process, and distribute cash or property, regardless of ownership, from unclaimed property in their possession. Ohio also administers an automated collection program, the Ohio State Unclaimed Property Management Program (OSU). - - - - - - - - - Processing Ohio's Unclaimed Fund State Programs all utilize the Unclaimed Fund Management State (UFOs) process and are managed by the OH State Unclaimed Property Management Program (OSU). The Division of Unclaimed Money oversees the process by which property is identified as unclaimed and is passed from division to division, with individual and corporate offices located in Cleveland, Cleveland Heights, Canton, Independence, Mahoning, Tuscaroras and Van Were counties. Funds can be claimed through Ohio's Unclaimed Money Program as long as the property was held by the Ohio Department of Commerce or an agency of the Ohio Department of Commerce by June 30, 2009, or has been in the possession of the Ohio Department of Commerce or an agency of the Ohio Department of Commerce since June 30, 2009. There are, however, many requirements that must be met for a fund to qualify as eligible for compensation from the Ohio Unclaimed Funds Program. An eligible fund must be at least fifty-five (55) years old at the time it was designated as unclaimed. You must apply for compensation through Ohio's State Unclaimed Funds Program. An Ohio Unclaimed Trustee must be appointed at the time the funds are claimed by the recipient. An Unclaimed Funds account is defined by the Unclaimed Funds Administration and Management Act (FMA). Ohio's statutes define an Unclaimed Funds Account as “a fund that has been or is being held for and by a federal, state, or municipal government or agency.

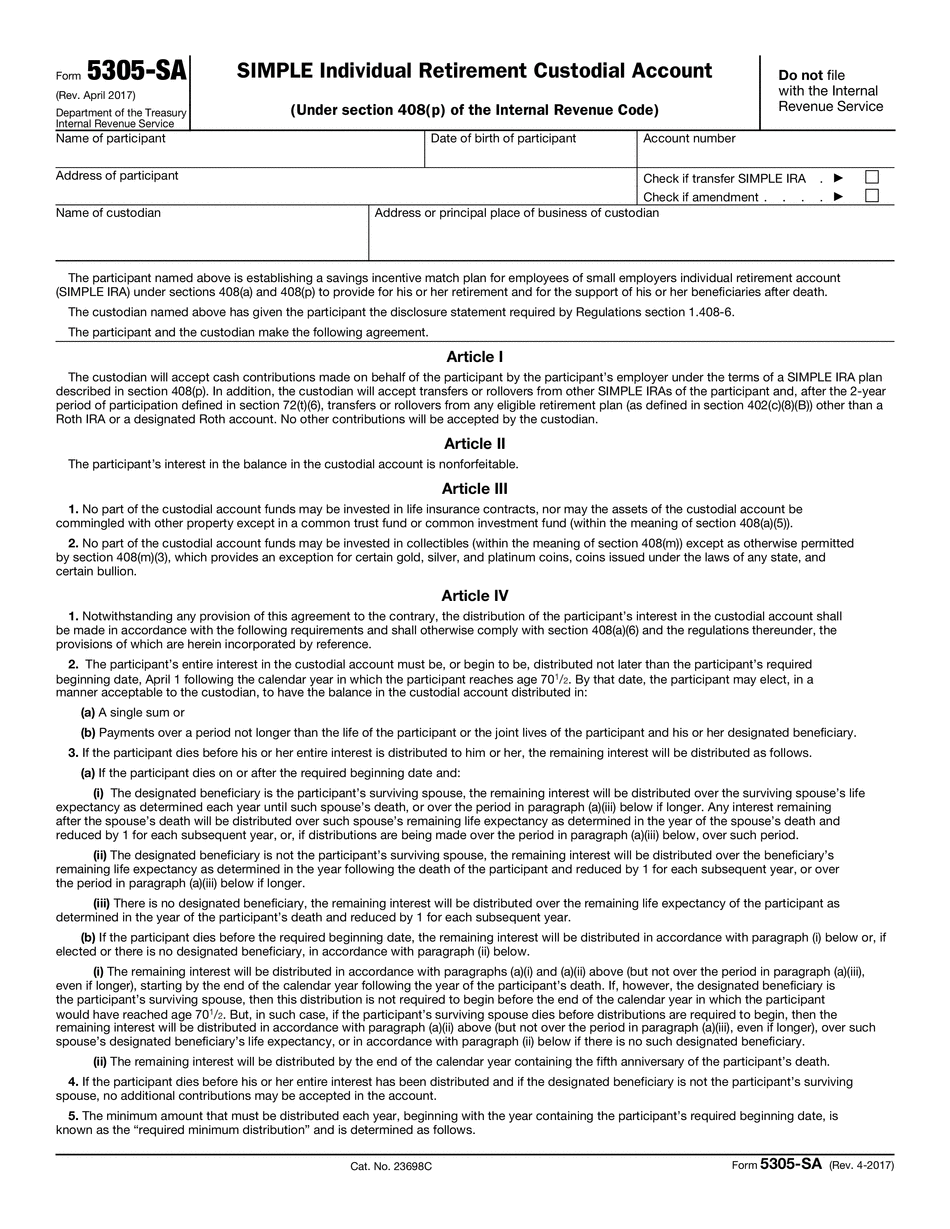

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 5305-SA Dayton Ohio, keep away from glitches and furnish it inside a timely method:

How to complete a Form 5305-SA Dayton Ohio?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 5305-SA Dayton Ohio aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 5305-SA Dayton Ohio from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.