Award-winning PDF software

Form 5305-SA Minneapolis Minnesota: What You Should Know

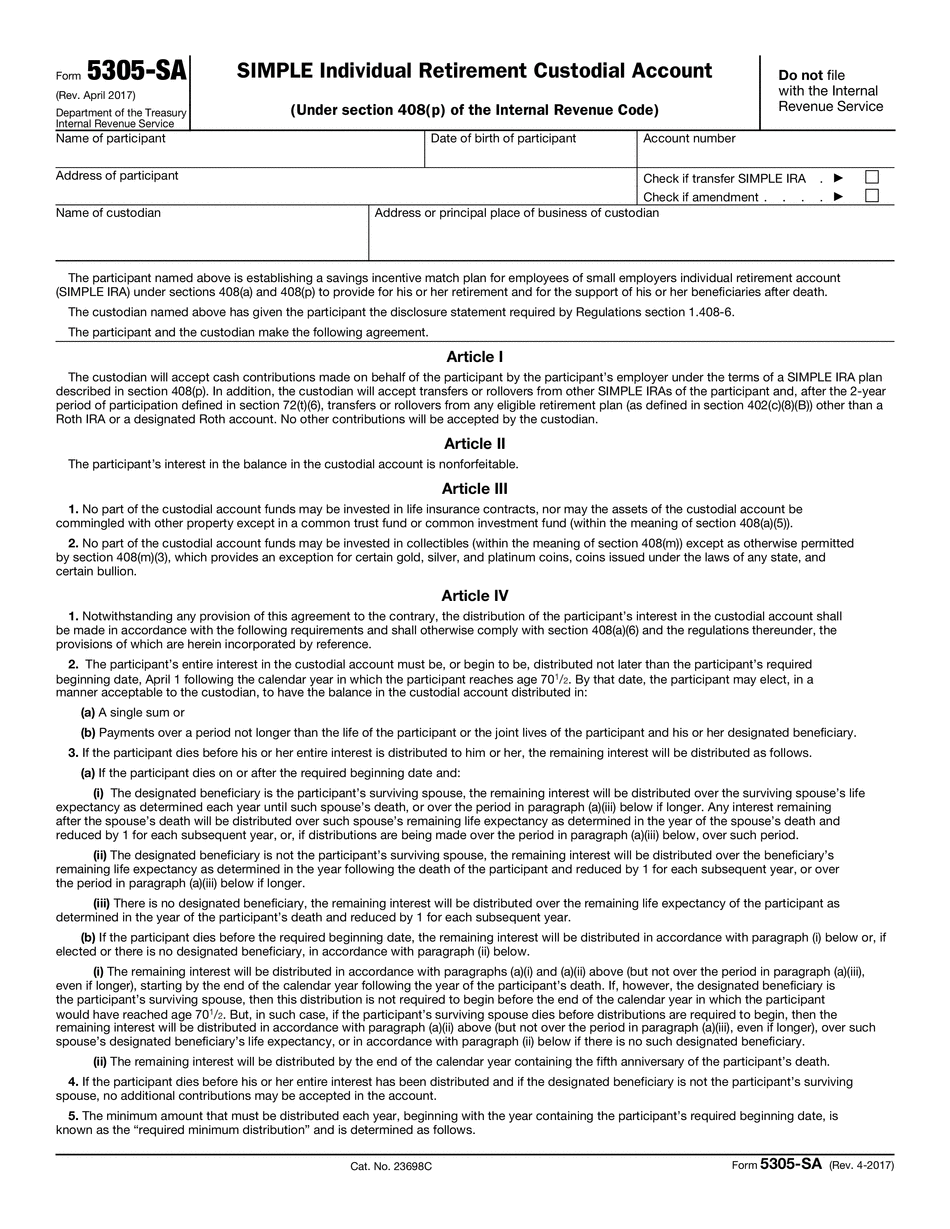

Click on IRS Replaces DOL Form 5305-S with Individual Retirement Account Dec 19, 2025 — The U.S. Treasury Department has replaced Form 5305-S with Form Individual Retirement Account. The IRS will have two versions of the form: one being the traditional version and one being the hybrid. When you make a conversion of a traditional IRA in 2016, all the existing custodial account rules apply. You will not be able to convert your traditional IRA without a custodial account. The traditional version is available at IRS.gov for download on the IRS Home Page. Click on form 5305-SA, which is not being sent to you via email. For more information on the hybrid IRA version, please refer to my previous post : Convert a Traditional IRA to a Roth IRAs . If you have questions about converting your traditional IRA to a Roth IRA, the link is included at the bottom of that page. This is a great opportunity for taxpayers to convert their traditional IRA to a Roth IRA and save tax-free as well as receive Roth IRA distributions tax-free. You can start making Roth IRA contributions as early as the first day of the year to make full use of the IRS Tax-Free Opportunity year-end (TFE) Roth conversion. Note: While you can make unlimited contributions to your Roth IRA, it is no longer the best tax deal due to the tax advantages, including the FICA tax deduction, of Traditional IRA contributions. IRS Releases Guidance for 2025 Tax Calendar : IRS.gov IRS Issues Guidance on 2025 Tax Calendar IRS Blog Post : IRS Blog Post: What Is the 2025 Tax Year-End Tax Tip: If You Don't Have A Deductible IRA, You Can Make a Deductible Traditional IRA Contribution to a Roth IRA. IRS.gov Blog Post: 2025 Tax Tip: Traditional IRA Conversions Without a Traditional IRA To Roth IRA Conversion Tax Tip: Get the most out of your 2025 IRA Contribution, 2025 Roth IRA Contribution, and 2025 Roth IRA Disclaimer The IRS recently issued a notice that they are removing outdated Form 5305-SA/B from the site. The notice details that the form no longer exists because the IRS has changed rules on a number of items that impact custodial account agreements.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 5305-SA Minneapolis Minnesota, keep away from glitches and furnish it inside a timely method:

How to complete a Form 5305-SA Minneapolis Minnesota?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 5305-SA Minneapolis Minnesota aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 5305-SA Minneapolis Minnesota from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.