Award-winning PDF software

Little Rock Arkansas Form 5305-SA: What You Should Know

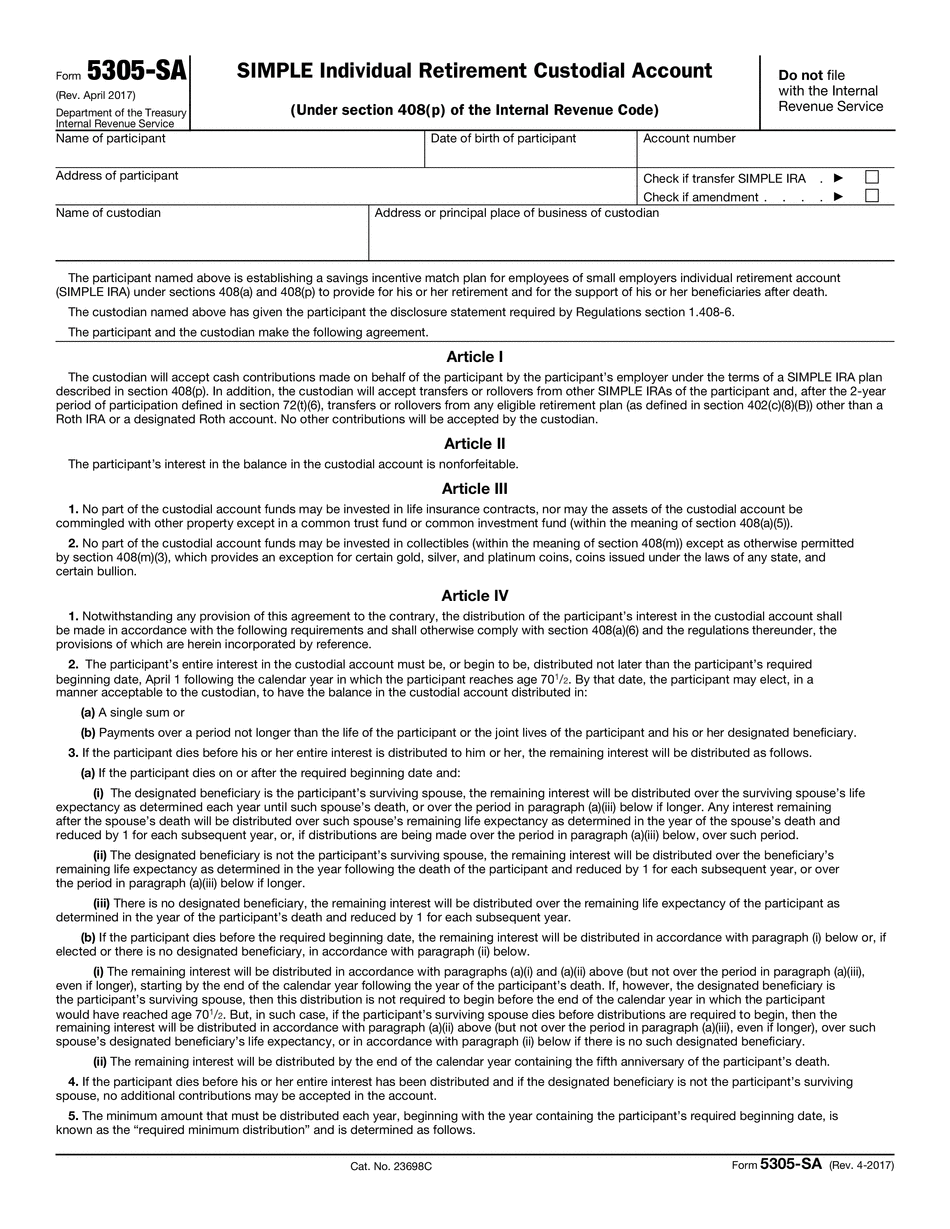

They have a revised filing guide with 2025 and future IRS forms added in the September 22, 2018, edition of IRS Publication 3, Tax Guide for Small Business, and a revised tax filing schedule for 2025 from the October 2025 edition of IRS Notice 2018-62, also known as “Annual Social Security and Medicare Income Guidelines”. We also updated our 2025 Tailing Guide in July 2025 which includes 2025 federal income tax return information based on the recently released 2025 IRS Social Security and Medicare Payment and Tax Payment Guide. 2 Tax Return Filing Date: October 18, 2017, Form 5305-S — Individual Retirement Incentive Match Plan (SIMPLE) April 18, 2025 — Form 5305-S, Individual Retirement Incentive Annual tax return filing is a big event for the IRS. The return should include: Form 1040, Schedule A; Form 1040A-1, Employment Tax and Self-Employment Credit Worksheet (includes instructions); Form 1040EZ, Estimated Tax. Form 5305-S — Individual Retirement Incentive Match Plan. SIMPLE, or SIMPLE IRA, is a type of retirement saving program created by the IRS. This form was added to the tax filing schedule on Oct 5, 1996. (Revised: 6/22/16) IRS Publication 334, Individual Income Tax Returns and Tax Filing Procedures, may be consulted for the current year filing deadline. The form is completed via an online questionnaire. After completion, the form will be sent to the participant and filed in the same manner as Form 5305-S. The participant's IRA is treated as a defined contribution retirement plan in the event that the contributions were not pre-tax. For contributions to retirement plans made after January 1, 2017, these requirements apply as of the date of the election. If the defined contribution benefit is equal to or greater than the income eligible for IRA distributions, then IRA distributions may be made from the plan without regard to whether a contribution was made before January 1, 2017. As of April 2018, these terms are no longer part of the tax code. Instead, the IRA tax exclusion becomes a regular exclusion and withdrawals from an IRA are not taxable.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Little Rock Arkansas Form 5305-SA, keep away from glitches and furnish it inside a timely method:

How to complete a Little Rock Arkansas Form 5305-SA?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Little Rock Arkansas Form 5305-SA aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Little Rock Arkansas Form 5305-SA from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.