Award-winning PDF software

Form 5305-SA ND: What You Should Know

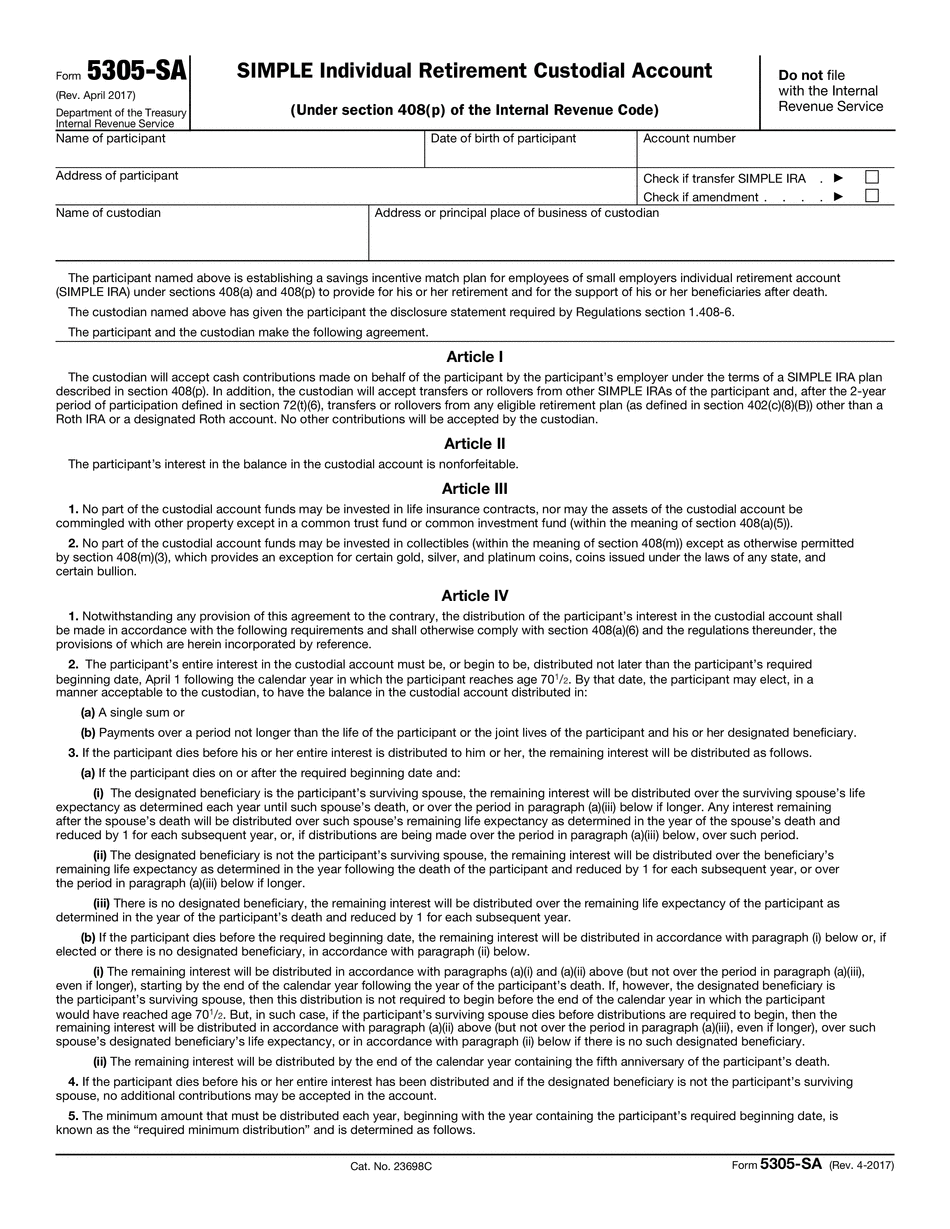

This will be done when a beneficiary or trustee will be established in the 2018 federal tax year. The form, if the following requirements are met, is valid and will be valid for the federal taxation year 2021 IRS Finally Issues Forms This time for the following form in the current year The Form 5305-SA is the form that will be used to establish the savings interest incentive program that will be used to pay for qualified provide medical insurance coverage for covered individuals. This form of account may be used by a participant (as the participant) and any eligible beneficiary to establish financial security in retirement or to plan an immediate sale of the account during retirement. The form must be executed by the person who is a participant in a 401(k) account and by the person who is the beneficiary of the account. This is also known by the form title: SIMPLE Individual Retirement Custodial Account or Individual Retirement Custody. A SIMPLE IRA may be used in the current tax year and must be established before December 31 at the earliest. The person who is the participant and the custodian (the person who makes sure the account is secure and contains funds) must agree in writing that the account will be used solely for the specific purpose for which it is to be established and that no other purpose for the account may be authorized. In the case of an individual who has less than 50,000 of annual income, a statement from the person or entity who is the custodian must be included at the top of every provide tax return if the person or entity is an employer. The form may be used for a one-year, three-year or five-year period Filing Requirements for SIMPLE-IRA for a one-year time period You will need to sign the tax return form (Form 5305-SA) and submit it with your 2025 tax. For a three-year time period or more if you have less than 50,000 and your annual account balance is more than 500,000, you will need to file Form 5305-SA every fourth year. After two years have passed, and you have not filed a 5305-S, you need to submit a filing to IRS.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 5305-SA ND, keep away from glitches and furnish it inside a timely method:

How to complete a Form 5305-SA ND?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 5305-SA ND aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 5305-SA ND from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.