Award-winning PDF software

Form 5305-SA online Connecticut: What You Should Know

CO-1068 If you are a Connecticut resident, your spouse and family members have all the assets and must have a joint income and financial responsibility (MFR). CO-1068 provides an opportunity for you to make a property agreement with your family members, allowing for the transfer of your property to the family members without your spouse or dependents. The co-pays for medical care that you are covered for have increased on March 1, 2013. CO-1068 is a comprehensive agreement regarding the property and financial responsibilities of your spouse if you are: (1) a Connecticut resident; and (2) married to another person; and are also required by your spouse's MFR to make co-payments to cover any health care costs incurred by you as a Connecticut resident. The joint property/financial responsibility and co-paid medical expense agreement includes the following: (i) a property agreement, to show that we are making payment for those who are not married to us; (ii) a financial responsibility agreement, to show that we are making payment with that property as well as an assumption of financial responsibility; (iii) a health care liability agreement, to show that we are making payment for that care (excluding dental care) If your state has covenanted and approved a “property agreement with a family member” the covenanted covenants are not applicable. CO-1069 The property transfer tax on a deceased spouse is calculated as the total value of property transferred minus the value remaining after the deductions for the deceased spouse. For the current year's property transfer tax, see the State of Connecticut's website to see the full formula. For the 2025 filing year, the formula for calculating the combined property transfer tax would be CO-919. The financial responsibility will determine if there is more than 75,000 in assets available to pay the entire property transfer tax. Co-payments can occur up front or over the first 5 years of the settlement, whichever is shorter. CO-1068 (Form 1068) is an example property transfer tax statement if an annual property transfer tax payment is required in Connecticut. These documents are typically used for people who have filed joint state returns with their spouse and for people who had lived in the state less than 5-years prior filing the joint state return. Coverage and Benefits Financial assistance for medical expenses is not available.

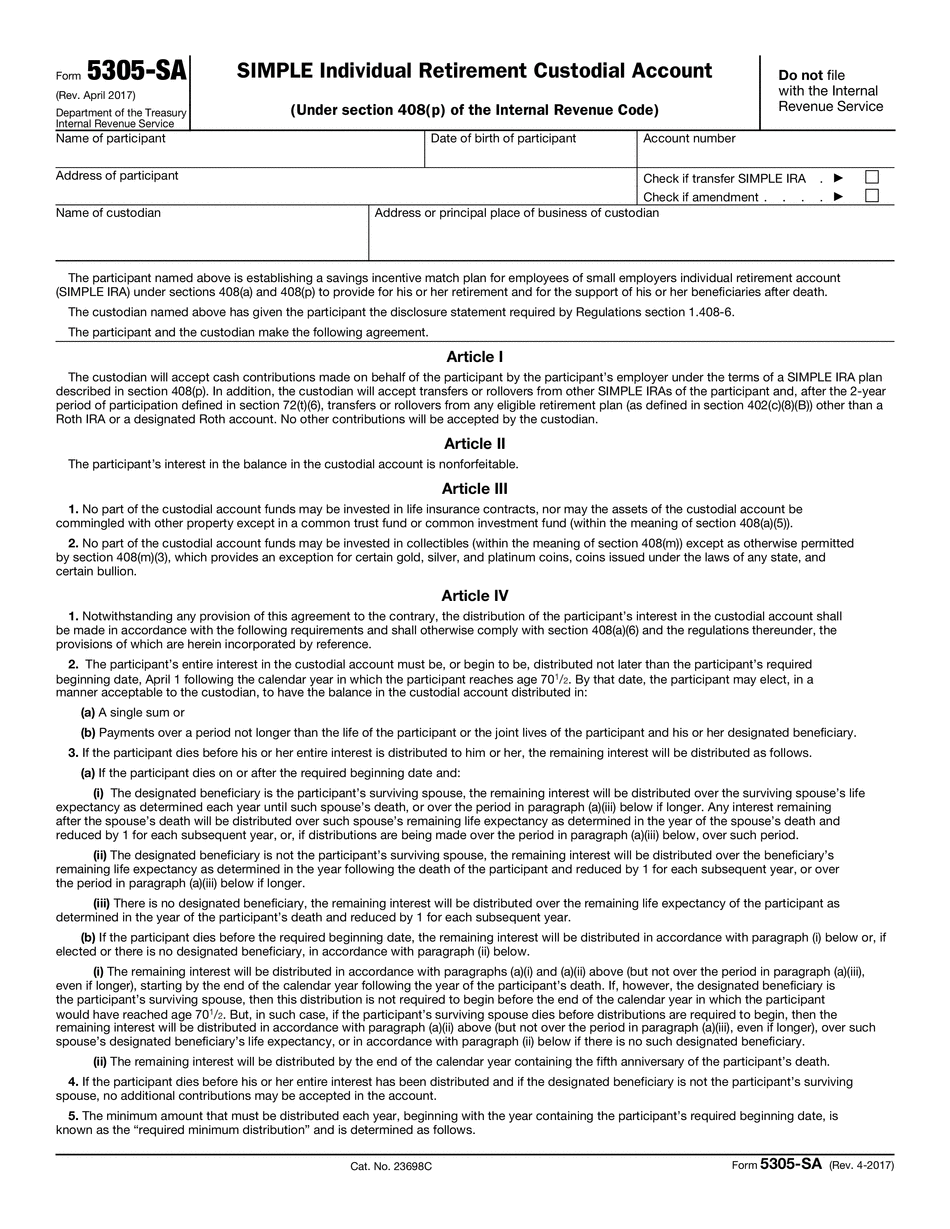

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 5305-SA online Connecticut, keep away from glitches and furnish it inside a timely method:

How to complete a Form 5305-SA online Connecticut?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 5305-SA online Connecticut aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 5305-SA online Connecticut from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.