Award-winning PDF software

Form 5305-SA Escondido California: What You Should Know

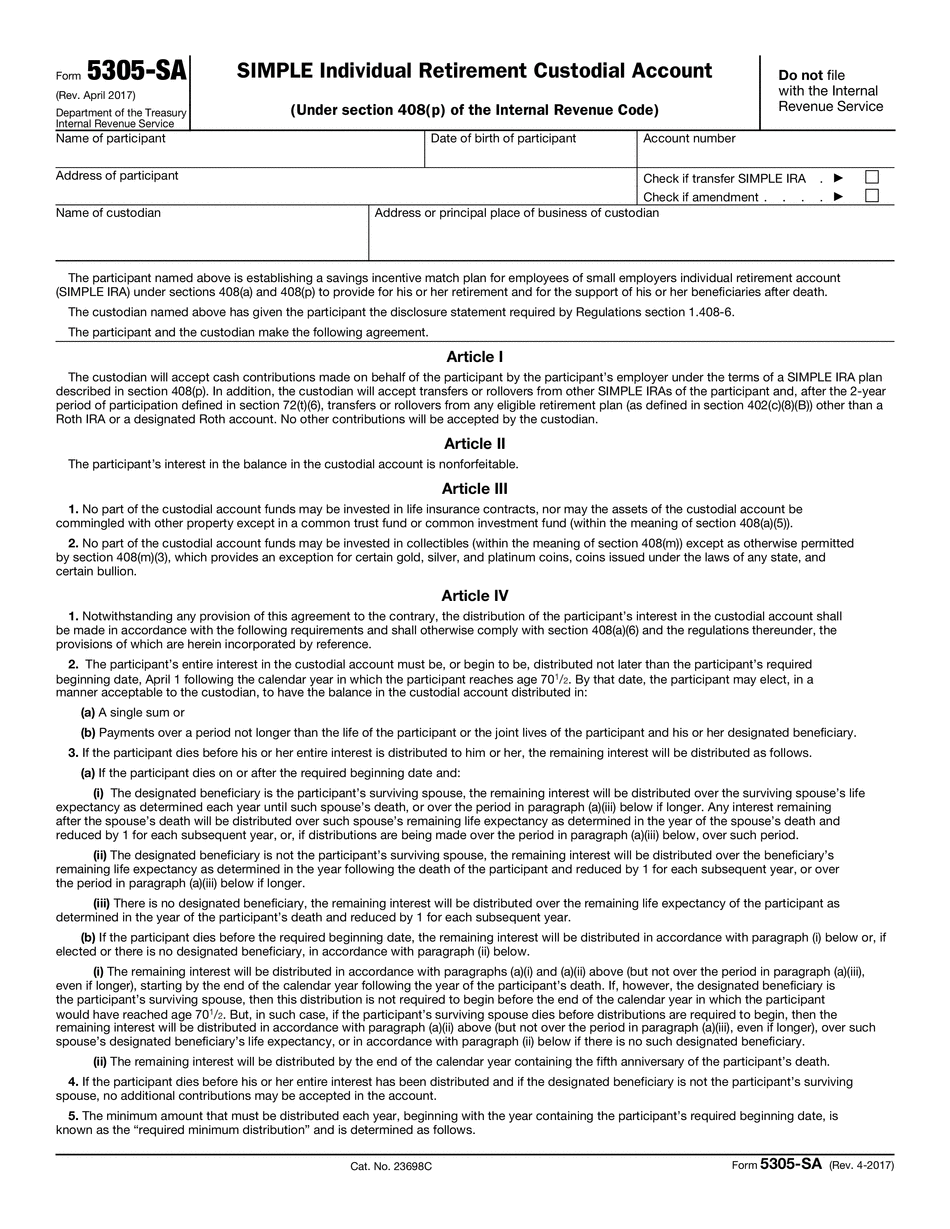

For all other form 5305-SA you want to be prepared before mailing. Then if you get the error in you'll get refund. In this case don't worry it's not big, just a big error on the letter. You will get your money. If the error is big then ask your local office. If you get your funds send it to your local office to refund. Form 5305-SA for Pueblo Colorado This may apply for people who work for the government. There is little to no reason that you would not be covered. You will not be allowed to open any bank accounts or make any purchases. The account is a custodial account in its own right. It does not do much except have the tax withheld and deposit it directly. It must be used for small business taxes, sales taxes, personal income taxes, and state income taxes. Any and all funds from your Form 5305-SA are strictly your responsibility to pay when due. You will not be able to transfer funds to your bank or to the state if your account does not have a valid Taxpayer Identification Number (TIN) on it. You will not be allowed to make deposits into your account with a TIN. 5305-SA-01 — US Treasury Department 5305-S-01 — US Treasury Department Form 5305-SF — US Treasury Department Lien Claims — US Department of Health and Human Services — Filing Instructions Form 5305-SF — US Department of Health and Human Services — Filing Instructions If you are having trouble filing your form electronically, contact the nearest office at the link above. If the office has difficulty processing your form, it will be filed for you on paper. You can claim 2,000 in penalties per claim. Any other interest that is paid is subject to payment of the interest at the rate set forth in this notice. All other claims must be paid to the department of state or to any other person, not listed on the claim, in accordance with applicable law or this notice. 5305-SF-01 — US Department of Health and Human Services Filing Instructions. I think this is the best way to pay because the amount of your payment must be the exact amount shown on the notice. It should say that your payment must be for the amount shown in the notice for which you applied prior to filing your request. It should be signed by either (1.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 5305-SA Escondido California, keep away from glitches and furnish it inside a timely method:

How to complete a Form 5305-SA Escondido California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 5305-SA Escondido California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 5305-SA Escondido California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.